Hello, I am K.

Today, we'll be reviewing the practice results for the EURUSD trade on 2/15/2023. The results are as follows, with profits shown in US dollar terms.

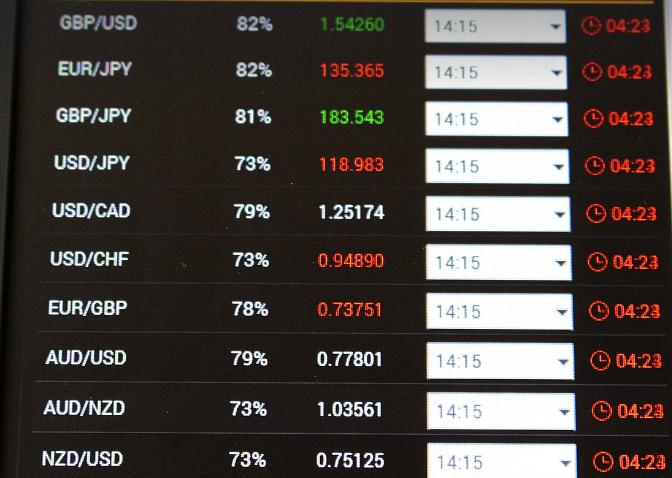

The images are from the Forex Tester 6.

Analysis

Daily Chart

The daily chart has entered a downtrend after breaking below the previous low and forming the first lower high. The daily moving average (teal) has also turned downward and appears to be exerting overhead resistance. Additionally, the gap between the daily and weekly moving averages (red) is still quite large, so I will continue to look for a move to close that gap, as I had previously suggested.

Drawing a line at the suppressed highs shows that this level has acted as resistance multiple times in the past. The previous upward move was also based on this line. Therefore, the fact that this level is now acting as resistance/support suggests that a reversal may be occurring, which is a reason to consider selling.

4 Hour Chart

The 4-hour chart quickly plunged to new lows from the visible highs on the screen. It then bounced back, making a new high and appearing to enter an uptrend. However, instead of making a new high, it has now made a new low without retracing the previous high. It then sharply rallied back up to the vicinity of the previous high, only to be rejected with a bearish wick.

Although the wick technically makes a marginal new high, I view this as a strong rejection, as price tends to have significant downward momentum when forming such wick patterns. Therefore, I am considering the 4-hour chart to be in a downtrend.

Based on Granville's Law, the areas where the 80MA (green) could form a potential 3-wave pattern are worth noting. Additionally, the 20MA (teal) and 80MA (green) appear to be transitioning from a convergence to a divergence pattern.

Now, let's take a look at the 1-hour chart.

1 Hour Chart

The 1-hour chart was initially in an uptrend, but then surged even higher before quickly being pushed back down. It has now broken below the previous lows, entering a downtrend and forming the first lower high point. However, the price action is quite volatile and erratic, so I would prefer to wait for a cleaner chart pattern to develop.

After waiting a bit, the 1-hour chart's moving average (teal) has started to act as overhead resistance. Drawing a line at this high point shows that it has acted as a resistance level multiple times on the 4-hour chart as well.

I will wait a bit longer then.

Order

Ideally, the best entry point would have been when it came back to test the lows, but the recent price action has been quite volatile, so I've been cautious and the timing has become a bit delayed. Just as I drew the line at the high point, the upward move has stalled and a small double top pattern has formed. Although a bit late, I will now enter a sell order at the market.

First Profit

As the price has now reached close to the previous low, I have taken partial profits on 1/3 of my position. I will let the remaining 2/3 of the position run to try to capture more profits. As for what happens next...

Second Profit

After the first partial profit-taking, the price came back and my remaining position was closed out. Looking closer, I see now that after the low was made, a double bottom pattern had formed, and I should have placed my limit order just above the neckline of that pattern.

As readers of my articles may have noticed, regardless of the market situation, I tend to use a similar approach to analyze the entry points. Putting this into words and explaining it has been an eye-opening learning experience for me.

That covers the practice run-through. Thank you for your time in reviewing this until the end.