Hello. I am K.

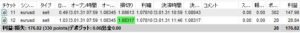

Today, I'll analyze my EURUSD practice trading results from 2023/1/31. The results are shown below. Profits/losses are displayed in USD.

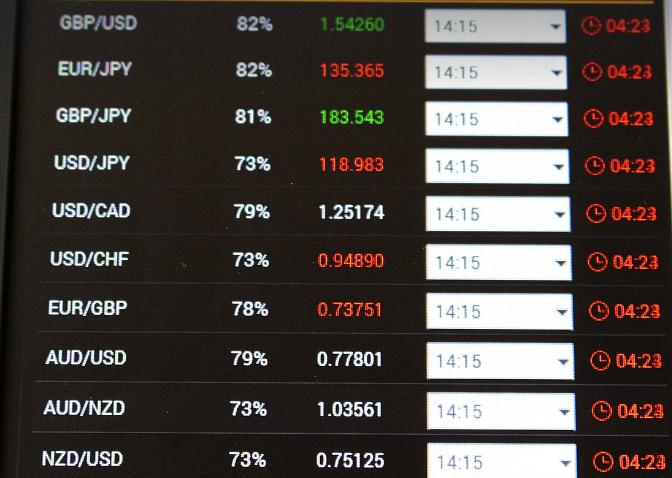

The image is from Forex Tester 6.

Analysis

Daily Chart

Although the short position from my 2023/1/27 entry was stopped out, the daily chart formed an upper shadow, and it looks like the price might still converge with the daily MA, so I'll look for another selling opportunity.

Additionally, I'm watching if this movement could develop into a correction that fills the gap between the current price and the weekly MA (shown in red), as there is significant deviation between them.

4 hour chart

On the 4-hour chart, after failing to make new highs in the uptrend, the price appears ready to enter a downtrend if it breaks below the recent low. The 20MA has turned downward, increasing the probability of successful short positions. While the 80MA (green line) just below the current price is a concern, if price breaks below the recent low, it would also break the neckline of what appears to be a larger triple top pattern. This could lead to a move toward the 4-hour MA (red line), so I'll continue to consider short positions. Currently, price is at the right shoulder of the triple top pattern and making lower highs.

The line where price temporarily stopped rising after its sharp decline is a price level that has acted as resistance multiple times in the past, suggesting it could be a strong resistance zone.

1 hour chart

On the 1-hour chart, I see a downtrend forming as the price rapidly broke down from its uptrend, making new lows and lower highs.

According to Granville's Law, this could develop into a third wave pattern. Looking at the MAs, both the 1-hour and 4-hour MAs appear to be transitioning from convergence to divergence.

Therefore, since breaking below the previous low would confirm the continuation of the downtrend, I placed a sell order at the point where price breaks below this low.

After Order Entry

The sell order was executed. After that...

First Take Profit

Since the price extended downward, I took profit on 1/3 of the position. I moved the stop loss to break-even, and will aim to let profits run with the remaining 2/3 of the position.

Second Take Profit

The next candle sharply reversed, and all remaining positions were closed. I'm finding it difficult to let profits run. In my experience, EURUSD tends to make more retracement moves compared to yen crosses. However, I'm using partial position closing to ensure some profit remains even when price reverses against me.

And with that, this concludes the results of today's practice trading.

[Study] → [Understand] → [Be able to implement] → [Explain].

I am currently OUTPUTTING [Explain].

Explaining the rationale for trading to you all is a good way for me to learn.

I may have missed some parts, but thank you very much for reading to the end.