Hello, my name is K.

This time we will look at the 2023/1/5 EURUSD practice results, orders and plan. The results are as follows. Profit is shown in dollars.

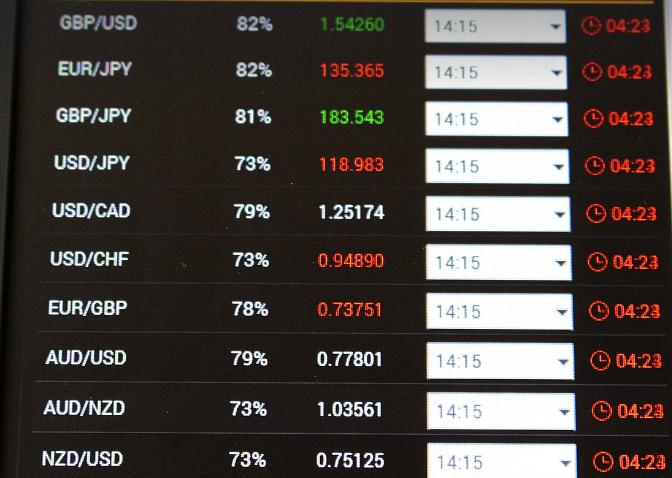

The image is from Forex Tetser6.

Plan

Daily Chart

The uptrend was in an uptrend at the daily level, but failed to make a new high, broke through the previous low, and formed a double top. We see it entering a downtrend.

In addition, the daily MA has once broken below the 20 MA, and the 20 MA appears to be holding the head, and the scene is about to show a converging move to this with the weekly MA diverging from it. Therefore, I am considering whether we can follow the move to fill the area of the white frame.

However, the weekly 20MA is still up. The final target is before the weekly 20MA as it may be pushed back to the weekly level from here.

4-hour chart

The 4-hour chart was in an uptrend, but it broke out of the previous low and entered a downtrend. A high cut-off point is forming which could be the first reversal.

The point at which this initial rise stopped is confirmed by the horizontal line, a point that has been reacted to many times in the past as shown below.

I believed that this would end the upward reversal and give momentum to the downside again. Also, there is an advantage to the downside from Granville's Law at the 4-hour level, where it could be a 3-wave.

Now, let's look at the lower chart, the hourly.

1-hour chart

The 1-hour chart is in an uptrend after a brief decline, followed by a range-like movement. The range-like area has formed a triple top, although the shape is not clean. The high on the right shoulder that looks like a triple top has also been slightly devalued from the high in the middle.

This is also the point where the 1-hour MA (light blue) and 4-hour MA (red) converge and also head for another spread.

Therefore, we have set an order at the point where the previous low will be broken below the neckline of the triple top.

After placing an order

The order was executed as the price fell at once, probably because the traders who had bought at one point in the rise lost their money. First of all, we would like to extend the price to the previous low.

1st Profit

The previous low was reached. The stop loss is moved to a non-negative position and 1/3 of the position is profitable. Profit will be extended in the remaining 2/3.

Each time the high price is lowered, the profit position is moved.

2nd Profit

It then rose quickly and was closed at the gain line that had been moved.

So that is all for the results of this exercise.

[Study] → [Understand] → [Be able to implement] → [Explain].

I am currently OUTPUTTING [Explain].

Explaining the rationale for trading to you all is a good way for me to learn.

I may have missed some parts, but thank you very much for reading to the end.